flow through entity irs

Participate Any rental without regard to whether or not the taxpayer materially participates A single entity. For example if a US.

Form W 8imy Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding

Any payments toward a flow-through entitys 2021 calendar tax year that are made after March 15 2022 will be claimed as a credit against members 2022 tax liability.

. Its gains and losses are allocated. Types of flow-through entities. Flow-Through Entity Tax - Ask A Question.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. A business owned and operated by a single individual.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. Understanding What a Flow-Through Entity Is.

Flow-through entities FTEs affect an individuals Foreign Tax. In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the updates. Flow-through entities are considered to be pass-through entities.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Log on to Michigan Treasury Online MTO to update. The entitys income only goes through a.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Rules for Flow-Through Entities. Payments made to a foreign intermediary or foreign flow-through entity are treated as made to the payees on whose behalf the intermediary or entity acts.

Withholding agent makes a payment of portfolio interest described in section 871h to an account maintained by a nonparticipating FFI the payment will be subject. This means that the flow-through entity is responsible. Most small businessesand quite a few larger onesare set up as pass-through entities.

Advantages of a Flow-Through Entity. There are three main types of flow-through entities. However the late filing of 2021 FTE returns will be.

This disconnect between receipt of cash and. That is the income of the entity is treated as the income of the investors or owners. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the.

A flow-through entity is also called a pass-through entity. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated. Passive Activity A trade or business in which.

A trust maintained primarily for the benefit of. There are two major reasons why owners choose a flow-through entity. Flow-Through Entities Effects on FTC NOTE.

This Practice Unit is updated to reflect the recent finalized Treas.

Instructions For Form 8995 2021 Internal Revenue Service

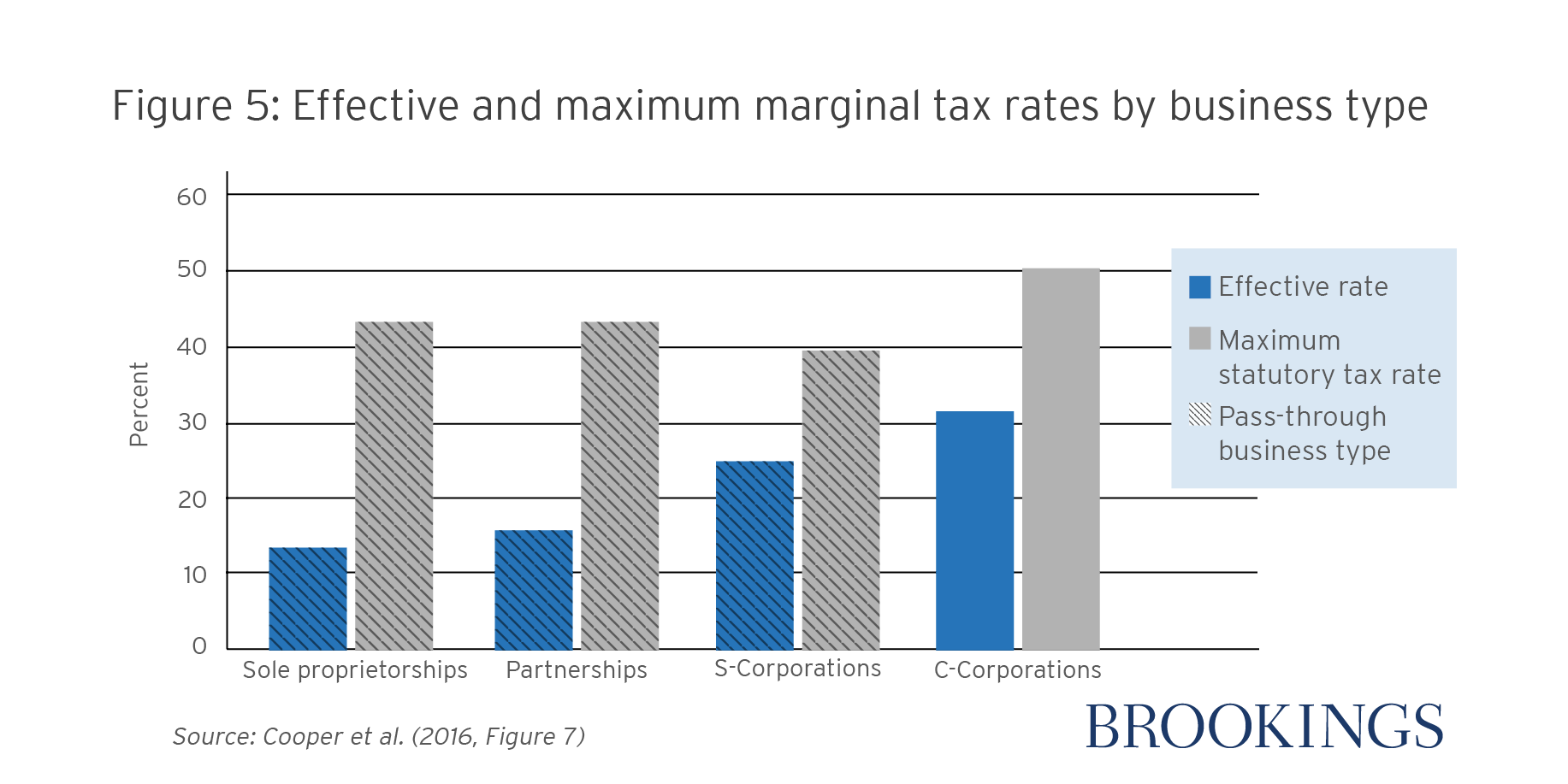

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

4 10 3 Examination Techniques Internal Revenue Service

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Irs Issues Faq Guidance And Additional Relief For Pass Through Entity Returns

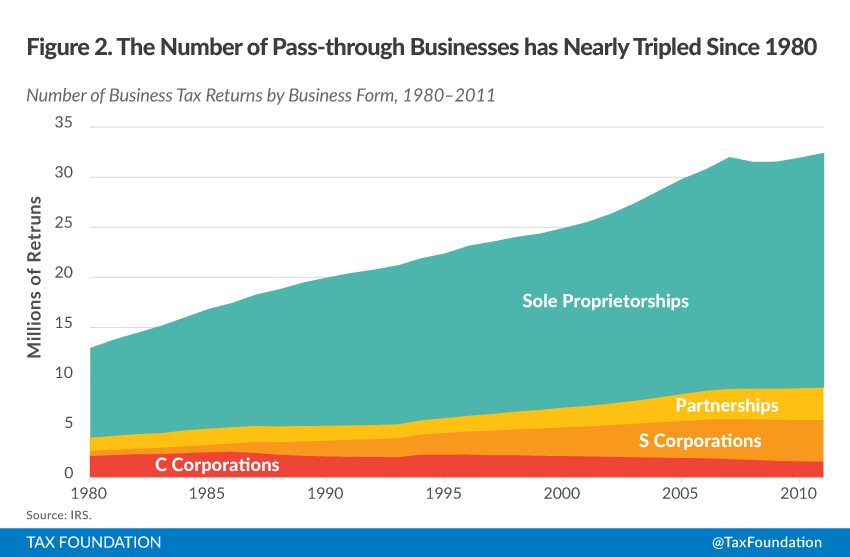

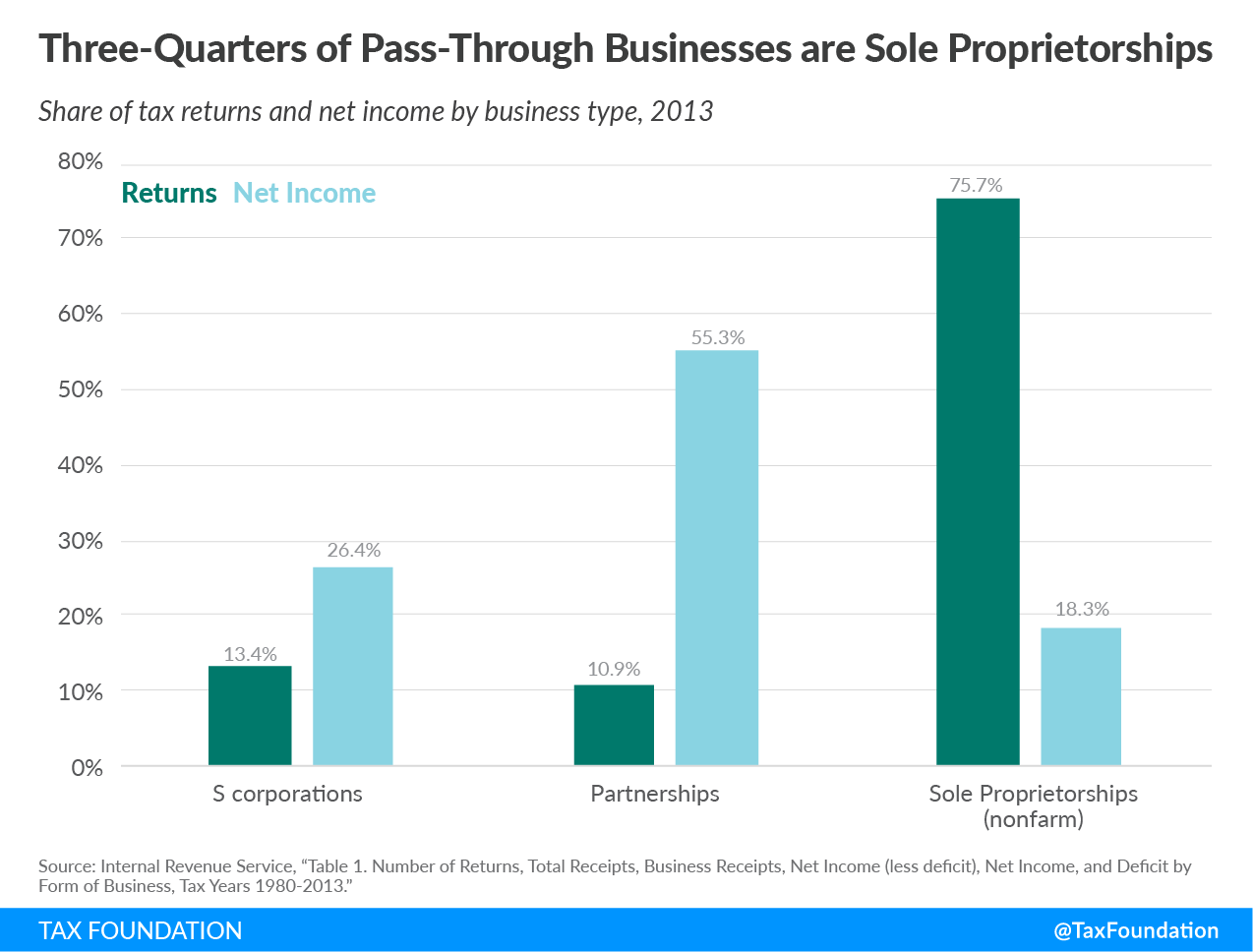

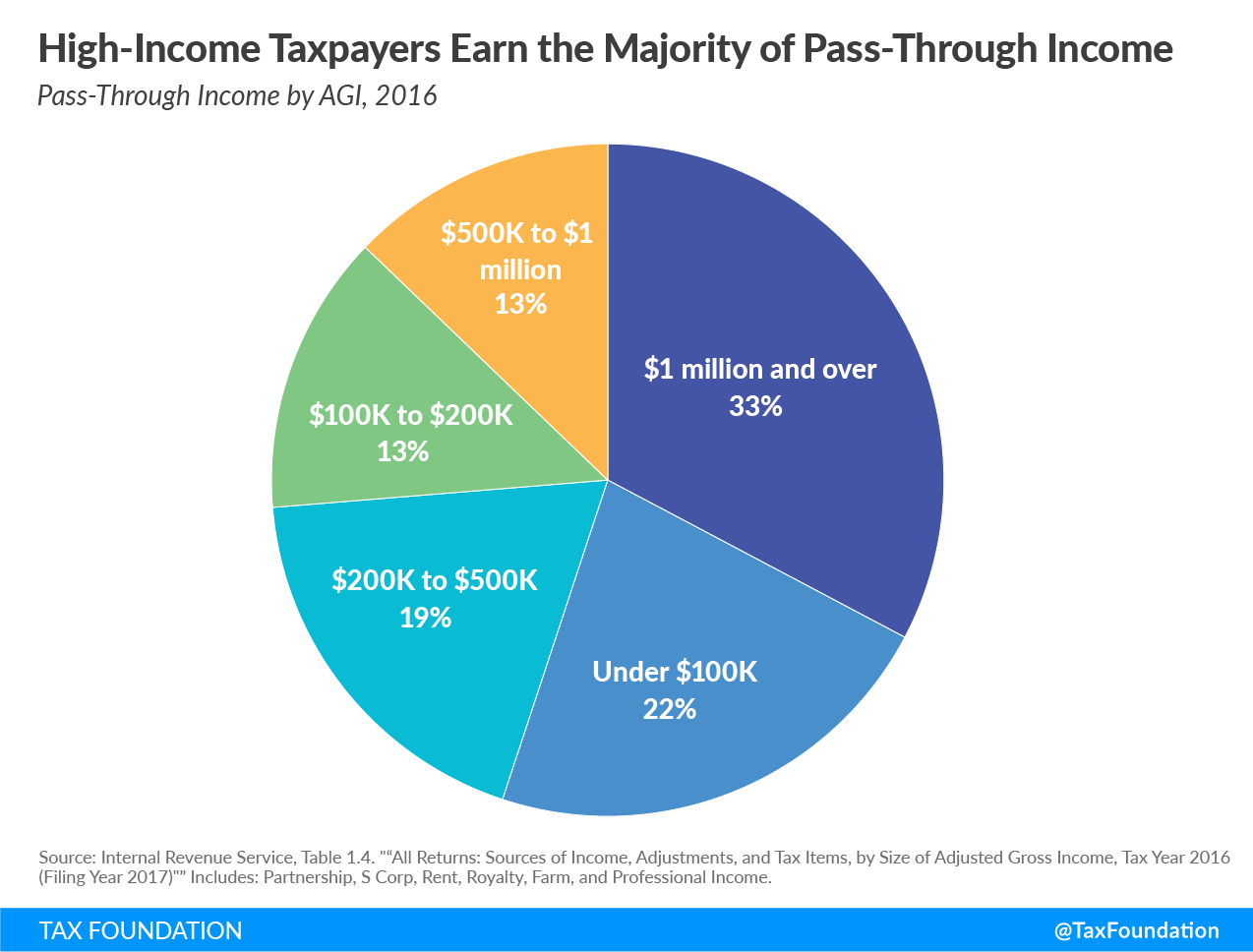

An Overview Of Pass Through Businesses In The United States Tax Foundation

S Corporation Tax Secrets How To Build Tax Free Wealth For Life Using Flow Through Entities Tax Man Books Wesley Lambert Harold 9798435950977 Amazon Com Books

Pass Through Entity Tax 101 Baker Tilly

What Is A Pass Through Business How Is It Taxed Tax Foundation

Do I Qualify For The Qualified Business Income Qbi Deduction Alloy Silverstein

An Overview Of Pass Through Businesses In The United States Tax Foundation

What Is A Pass Through Business How Is It Taxed Tax Foundation

3 13 2 Bmf Account Numbers Internal Revenue Service

Part Ii Irs Form W8 Imy Fatca Driven More On The W 9 And W 8 Alphabet Soup With Fatca Irs Form W8 Imy Tax Expatriation

What Are Pass Through Businesses Tax Policy Center

Single Member Limited Liability Companies Internal Revenue Service